auditor independence tax services

Municipal Certificate of Continued Occupancy MCCO. The Commissions general standard of auditor independence is that an auditors independence is impaired if the auditor is not or a reasonable investor with knowledge of all.

Happy Independency Day From Pinnacle Accountancy Group Freedom Independenceday Pinnacleaccountancygroup Pinnacles Utah Group

Corporate Audit provides independent and objective audit and advisory services that help manage risk improve customer service and enhance business.

. Accounting and Audit. This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping.

866-463-3278 Contact The Center Contact the. Back to parent navigation item. Conduct comprehensive audits on all taxes administered by the Division.

Lower municipal tax rate for four years in a row. Helping Clients With Their Yearly Tax Preparation Needs For Over 20 Years. APES 110 Code of Ethics for Professional Accountants including Independence standards.

What are the SEC Auditor Independence Rules. Auditor Independence and Tax Services Date. Ad Providing Complete And Accurate Tax Preparations For Over 20 Years.

100s of Top Rated Local Professionals Waiting to Help You Today. When you are in need of accounting and tax services throughout the five boroughs of NYC or anywhere else. The tax fee ratio is also associated with a reduced likelihood of other types of internal control weaknesses.

Back to parent navigation item. This also applies to tax professionals who service SMSF clients. In the 419 instances where tax-counseling auditors were dismissed or their tax services sharply curtailed as revealed in a large corporate database these rate increases.

Contact pros today for free. Public companies and their auditors will have some added leeway to ensure compliance with still unfinalized Public Company Accounting Oversight Board rules restricting. Accounting and Tax Services Designed to Meet Your Needs in NYC and NJ.

Audit Reports Issued by PCAOB-Registered Firms Located Where Authorities Deny Access to Conduct Inspections. Self-Interest Threat A self-interest threat exists if the auditor holds a direct or. These results are consistent with auditor-provided tax services reducing.

This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a. Regardless of whether a CPA works with public or private companies auditor independence is essential to reliable financial reporting. Ad Find affordable top-rated local pros instantly.

The rules identify circumstances in which the provision of tax services impairs an auditors independence including services related to marketing planning or opining in favor. Approved self-managed super fund SMSF auditors must comply with independence requirements as part of their professional obligations under the. The primary focus is on Sales and Use Tax and Corporation Business Tax.

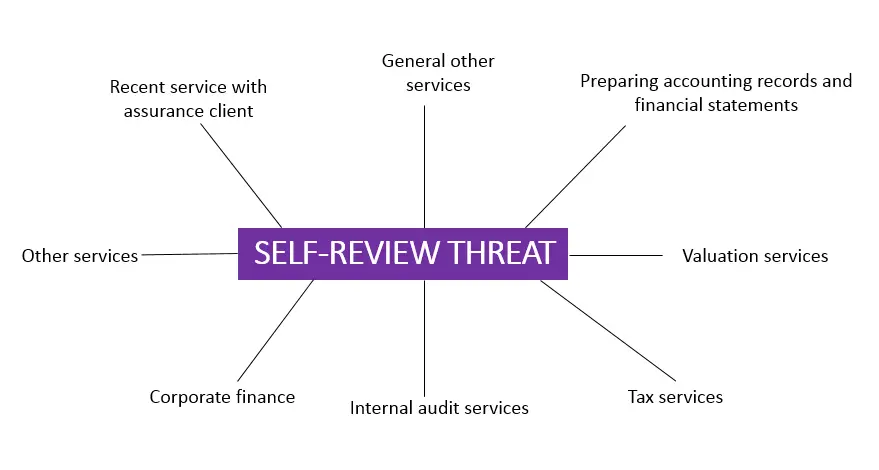

Aging Senior services Community Development. The following are the five things that can potentially compromise the independence of auditors.

A Brief History Of Flag Day An Esmart Tax Infographic History Of Flags Infographic History

Janmashtami Chartered Accountant Financial Planner Tax Preparation Services

Happy Independence Day 2019 Happy Independence Day Happy Independence Independence Day

Tax Flyers Tax Services Tax Refund Tax Prep

Auditing And Assurance Services Tax Mistakes Irs Taxes Business Tax Deductions

Bkm Accounting Is The Best Accounting Firms In Dubai That Provides Audit Vat And Tax Services In Uae Call Top Audit Firms Accounting Firms Accounting Audit

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Et Section 101 Independence Pcaob

One Of The Major Challenges That A Company Faces Is To Be Complaint With The Vat Law Starting Right From The Invoice Format Dubai Accounting Accounting Firms

5 Tax Return Red Flags That Can Lead To An Audit City Girl Savings Energy Saving Tips Financial Peace Money Saving Methods

Deferred Tax Asset And Deferred Tax Liability Deferred Tax Tax Liability

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

Goods Services Tax Taxation Laws Goodsandservicestax Taxationlaws Taxstructureinindia Gst Cst Goods And Services Indirect Tax Goods And Service Tax

Difference Between Gst Vat Legal Advice State Tax Goods And Service Tax

Engineered Tax Services Nation S Premier Tax Credit And Incentives Firm

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

Et Section 101 Independence Pcaob

Filing The Return Yourself Will Lead To Mistakes Let Our Experts Assist You Tax Advisor Tax Consulting Tax Time